How High A Carbon Tax

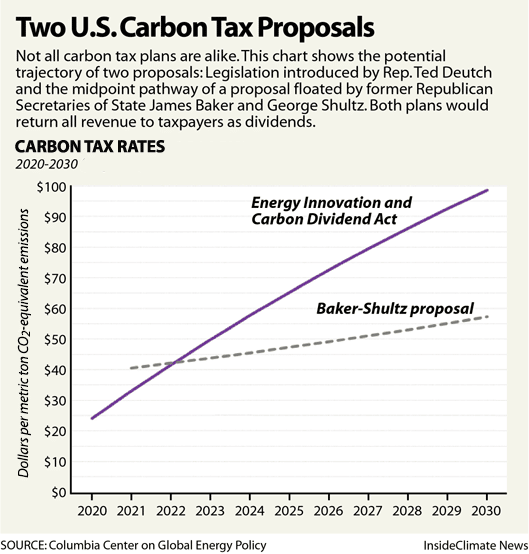

Baker-Shultz proposal: Although its plan has not been formally introduced yet, the framework laid out by the Climate Leadership Council, a coalition of industry and environmental groups that support the Baker-Shultz proposal, would start a carbon tax at about $40 per ton, escalating by 2 to 5 percent annually, and reaching as high as $65 per ton by 2030.

Energy Innovation and Carbon Dividend Act: The bipartisan measure sponsored by Rep. Ted Deutch and Rep. Francis Rooney would levy a carbon tax beginning at $15 per ton, escalating by $10 annually, and reaching $115 a ton by 2030. That averages out to a 24 percent annual increasehigher than any other recent climate proposal.

Why it matters: Cutting carbon emissions rapidly and deeply will be costly but necessary if the world aims to keep the global temperature increase to no more than 1.5 degrees Celsius. No one knows how high the carbon price will have to be to meet that goal, but it will depend on the pace of technological advances and other policies to encourage investors and consumers to choose clean energy, said Noah Kaufman, an economist at Columbia Universitys Center on Global Energy Policy, who has studied the current carbon pricing proposals.

The more complementary policies you have, the lower the carbon price you need, he said.

Ii Carbon Dividends For All Americans

All net proceeds from the carbon fee will be returned to the American people on an equal and quarterly basis. A family of four will receive approximately $2,000 in carbon dividend payments in the first year. This amount will grow as the carbon fee increases, creating a positive feedback loop: the more the climate is protected, the greater the dividend payments to all Americans. According to the U.S. Department of the Treasury, the vast majority of American families will receive more in carbon dividends than they pay in increased energy costs. The popularity of dividends will help ensure the longevity of a bipartisan grand bargain based on these pillars.

Grants From Climate Leadership Council

In 2018, CLC made grants and program expenditures outside of the United States totaling $128,128. Of that sum, $106,039 was spent on program services in Europe , and $22,089 on East Asia and the Pacific .

In 2018, CLCs sole U.S.-based grant recipient was the Urban Institute, a left-of-center think tank, which received $50,000 from CLC for carbon dividend research.

Also Check: Easy Baked Mac & Cheese Recipe

Iv Border Carbon Adjustment

Carbon-intensive exports to countries without comparable carbon pricing systems will receive rebates for carbon fees paid, while carbon-intensive imports from such countries will face fees on the carbon content of their products. A well-designed system of border carbon adjustments will enhance the competitiveness of American-based firms that are more energy-efficient than their foreign competitors, while preventing carbon leakage and free-riding by other nations. This will put America in the drivers seat of global climate policy and encourage other large emitters such as China and India to follow Americas lead and adopt carbon pricing of their own.

Iv Streamline Regulations So Businesses Invest With Confidence In Clean Energy

Streamlining regulations would improve efficiency, prevent redundancy, and give entrepreneurs the green light to invest in clean energy. It would also ensure we have a solution that is environmentally ambitious and politically viableand that would succeed in addressing climate change and strengthening the economy at the same time.

You May Like: Bak Industries Revolver X4 Hard Rolling Truck Bed Cover

Donors To Climate Leadership Council

The Climate Leadership Council was formed in 2016-2017, so little data on its funding is available as of October 2019. However, data from the service FoundationSearch indicates 5 grants in 2016-2017 totaling $1.35 million to CLC:

- Germeshausen Foundation: $100,000

CLC has also been awarded substantial grants from Arnold Ventures, a for-profit extension of the left-wing mega-funder the Laura and John Arnold Foundation. Between 2017 and 2019, Arnold Ventures had awarded CLC up to $1,500,000 starting in 2019, CLC is set to receive $3,000,000 in grants from Arnold Ventures by 2021.

In 2018, the biggest donations to CLC were as large as $500,000 other large donations were for $350,000, $200,000, $150,000, and $100,000 . Under IRS rules, CLC does not have to disclose its donors, only the amounts of their donations.

Linnabary: Utah Leaders Should Embrace The Baker

The Sixth Assessment Report of the United Nations Intergovernmental Panel on Climate Change, or IPCC, has released its sixth series of reports on the climate crisis. The Guardian said the report is the starkest warning yet of major inevitable and irreversible climate changes.

The lengthy report can be shortened to the message: If we do not reduce greenhouse gas emissions quickly, we will see a dramatic rise in the global average temperature. This rise in global average temperature will permanently change our climate and planet.

Here in Utah, we have seen the damaging effects of climate change. Utah has seen an average rise of two degrees Fahrenheit. Part of this dramatic rise in temperatures is the increase in droughts and wildfires. Air quality due to wildfire smoke has also impacted human health in the Salt Lake City area. It is for these reasons and more that we need action on the issue of climate change.

Inaction is not an option, and it is time for Utahs leaders to call for action on the national level. However, today, much of the climate action conversation is dominated by those who push for infeasible and unrealistic solutions like the Green New Deal. Proposals such as these do more to reshape our society and economy than fight climate change.

As former Republican President Ronald Reagan said, Preservation of our environment is not a liberal or conservative challenge it is common sense.

Ian Linnabary, Opinion Writer

Also Check: How To Become A Professional Baker

Could A Dividend Be Successful

The carbon dividend has had prominent, eclectic backers, from James Hansen, a prominent NASA-official-turned-climate-advocate, to Bob Ingliss, a former Republican representative from South Carolina.

But theres simply no good precedent. Like carbon taxes in general, it hasnt been implemented in any state. And that can worry legislators who are considering it.

Its not going to happen overnight weve been debating this for 30 years, former Senator Lott tells the New York Times. But he says the tide is turning.

If a carbon dividend does manage to pass, experts are optimistic that it would be popular. In an interview earlier this year, Anthony Leiserowitz, director of the Yale Program on Climate Change Communication, said, Once people have the experience of getting that check, there will be a huge constituency saying, Dont you dare touch my revenue.

Leiserowitz pointed to Alaska, where residents get a yearly cut of oil revenue from the Alaska Permanent Fund. It created the sort of popular demand that Leiserowitz thinks could make a carbon tax politically sustainable over the long term, protecting it from future politicians.

Of course, the end goal is to ditch fossil fuels. If the economy ever gets fully decarbonized, you wont be getting a big check in the mail from the dividend program.

Economic Model Of Carbon Emissions

To project future energy-related CO emissions, I utilize the Goulder-Hafstead Energy-Environment-Economy E3 CGE Model, an economy-wide model of the United States with international trade. The E3 model has been featured Confronting the Climate Challenge: US Policy Options, published by Columbia University Press , five peer-reviewed journal publications, and it participated Stanfords Energy Modeling Forum 32: Inter-model Comparison of US Greenhouse Gas Reduction Policy Options. For further analyses of a carbon tax using the E3 model, including a wider range of impact results, see www.rff.org/cpc.

Recommended Reading: Easy Baked Ziti No Meat

How Much Regulatory Rollback

Baker-Shultz proposal: Streamlining regulations and curbing state authority over climate policy are among the goals of the industry-backed Americans for Carbon Dividends, the political action group backing the Baker-Shultz plan. Its managing director, Ryan Costello, says the group has not yet decided on how broad a regulatory rollback it would seek. Exxon, in backing the proposal, has said existing carbon regulations would be made superfluous by a carbon tax.

Energy Innovation and Carbon Dividend Act: The Deutch bill would pause the Environmental Protection Agencys regulation of greenhouse gas emissions under the Clean Air Act for 10 years. If national climate goals remain unmet at that point, EPAs authority under the Clean Air Act would be restored. The bill would leave in place limits on emissions from vehicles, including Californias authority to apply more stringent emission standards. The bill also specifies that it would not preempt or supersede any state law or regulation, protecting renewable energy and clean fuel standards, the Northeasts Regional Greenhouse Gas Initiative and other steps that states have taken on climate change.

But other sources of emissions are more difficult to tackle with a taxespecially those from transportation, where petroleum is the primary fuel. A $50 per ton carbon tax, for example, would translate to 44 cents a gallon of gasoline, not enough to drive large changes in behavior when there are few alternatives available to drivers.

Iii Significant Regulatory Simplification

The third pillar is the streamlining of regulations that are no longer necessary upon the enactment of a rising carbon fee. In the majority of cases where a carbon fee offers a more cost-effective solution, the fee will replace regulations. All current and future federal stationary source carbon regulations, for example, would be displaced or preempted. This regulatory simplification will be contingent on the continued presence of an ambitious carbon fee. Trading regulations for a carbon price will promote economic growth and offer companies the certainty and flexibility they need to innovate and make long-term investments in a low-carbon future.

Read Also: How Long To Bake Cookies In Air Fryer

Applying The Carbon Dividends Framework To Other Countries

As an international research and advocacy organization, the Climate Leadership Council will adapt this carbon dividends framework to other leading greenhouse gas emitting countries and regions. With certain adjustments, the four-part framework outlined above offers a cost-effective, popular, and equitable climate solution for most major countries outside the United States. Each country, of course, will need to adapt this framework to fit its system of government and national circumstances. There may be, for example, significant differences in how the dividends are administered and in the appropriate level of regulatory simplification.

I A Gradually Rising Carbon Fee

Economists agree that an escalating carbon fee offers the most cost-effective climate policy solution, sending a powerful price signal to steer businesses and consumers towards a low-carbon future. Accordingly, the first pillar of our bipartisan plan is an economy-wide fee on CO2 emissions starting at $40 a ton and increasing every year at 5% above inflation. If implemented in 2021, this will cut U.S. CO2 emissions in half by 2035 and far exceed the U.S. Paris commitment. To ensure these targets are met, an Emissions Assurance Mechanism will temporarily increase the fee faster if key reduction benchmarks are not achieved.

Also Check: George T Baker Aviation School Miami

Why This Solution Is Fair

This plan will position all people to succeed as we transition to a low-carbon economy. It centers on the most cost-effective way to reduce emissions: a nationwide carbon fee. By returning all the revenue netted from the carbon fee to households, this plan ensures the clean energy future belongs to everyone.

At the same time, this plan will reinvigorate U.S. manufacturing. American industries are some of the worlds most carbon-efficient, but our manufacturers dont get any credit for their cleaner operations. A system of border carbon adjustments corrects this by charging a fee on imports at the border. A nationwide carbon fee will also drive further efficiency gains in the manufacturing sector and encourage the return of important supply chains back home. These are key objectives if we want to create better opportunities for American workers.

Why This Solution Will Work

A nationwide carbon fee is the most powerful tool we have to rapidly slash carbon emissions. Once passed into law, it will encourage clean energy investments across the economy. Entrepreneurs will innovate to meet the demand for low-carbon solutions. Carbon emissions will quickly fall, and measures of other air pollutants will improve. If emissions reductions dont happen fast enough, an emissions assurance mechanism will kick in to keep us on track.

This plan also recognizes the global nature of the climate problem. Its system of border carbon adjustments will encourage other countries to adopt similar policies and ensure America isnt reducing emissions at home while encouraging their growth overseas.

Also Check: Law Offices Of Rudolph Baker & Associates

Exxon Mobil Pledges $1 Million To Campaign To Promote Carbon Tax

- Exxon Mobil will donate $1 million to a group lobbying to place a tax on planet-warming carbon dioxide emissions.

- The group, Americans for Carbon Dividends, is promoting a conservative, free-market plan to reduce carbon emissions developed by James Baker III and George Shultz.

- The plan would provide regulatory certainty to energy companies and includes a proposal to limit the EPA’s authority to regulate carbon emissions.

Exxon Mobil will donate $1 million to a campaign promoting a tax to curb emissions of planet-warming carbon dioxide to U.S. lawmakers and the American public.

With the commitment, the world’s largest publicly traded oil company is throwing its financial support behind Americans for Carbon Dividends, an organization tasked with lobbying for a carbon tax plan developed by Republican statesmen James Baker III and George Shultz.

Exxon’s support comes at a time when U.S. lawmakers remain at an impasse over putting a price on greenhouse gas emissions, with many Republicans opposed to a carbon tax or cap-and-trade system. The policy vacuum at the national level threatens to leave energy companies grappling with a patchwork of state and regional policies.

A single, national tax policy would provide regulatory certainty to the energy industry, and the Baker-Shultz plan in particular seeks to limit the Environmental Protection Agency’s rule-making authority.

Exxon did not respond to a request for comment.

A Conservative Climate Solution: Republican Group Calls For Carbon Tax

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this articleGive this articleGive this article

A group of Republican elder statesmen is calling for a tax on carbon emissions to fight climate change.

The group, led by former Secretary of State James A. Baker III, with former Secretary of State George P. Shultz and Henry M. Paulson Jr., a former secretary of the Treasury, says that taxing carbon pollution produced by burning fossil fuels is a conservative climate solution based on free-market principles.

Mr. Baker is scheduled to meet on Wednesday with White House officials, including Vice President Mike Pence, Jared Kushner, the senior adviser to the president, and Gary D. Cohn, director of the National Economic Council, as well as Ivanka Trump.

In an interview, Mr. Baker said that the plan followed classic conservative principles of free-market solutions and small government. He suggested that even former President Ronald Reagan would have blessed the plan: Im not at all sure the Gipper wouldnt have been very happy with this. He said he had no idea how the proposal would be received by the current White House or Congress.

A carbon tax, which depends on rising prices of fossil fuels to reduce consumption, is supported in general by many Democrats, including Al Gore. Major oil companies, including Exxon Mobil, have come out in favor of the concept as well.

Don’t Miss: What Beans Are In Bush’s Baked Beans

The Smart Way To Reduce Emissions And Outmaneuver Our Rivals

James A. Baker III was the 61st secretary of state and 67th secretary of the treasury. Greg Bertelsen is chief executive of the Climate Leadership Council.

One thing has become crystal clear during the long-running debate about climate change: Most nations wont risk their own economic well-being in the hope of reversing what is clearly a global problem.

And it would be a mistake for the United States to do so without adopting a plan that compels other large carbon-emitting nations to do the same. The Biden administration is right to recognize the risks of climate change, but it has so far failed to come up with a way to ensure against the risk without ceding a competitive advantage to China and other nations. Republicans in Congress are right to worry about U.S. competitiveness. But by failing to meaningfully engage on the climate issue, they are handing Democrats a political advantage and missing an opportunity to strengthen our economy against international rivals.

However, there is an approach that would serve all interests the interests of Republicans and Democrats, as well as the interest of progress on both climate change and U.S. competitiveness. It lies in leveraging an underappreciated strength of our economy: our success in low carbon-emission production.

Read more:

Emissions Projections For The Climate Leadership Council Carbon Dividends Plan: 2021

An assessment of the impacts of the Carbon Dividend Plan on US energy-related CO emissions if the policy were to be fully implemented in 2023.

Reading time

In February 2017, the Climate Leadership Council , led by Ted Halstead and Republican statesmen George P. Shultz and James A. Baker III first introduced The Conservative Case for Carbon Dividends. CLCs Founding Members represent a diverse group of individuals, NGOs, energy companies, consumer good companies, and other multi-national firms.

CLCs updated Carbon Dividend Plan rests on four pillars:

A Gradually Increasing Carbon Tax: The first pillar of our bipartisan plan is an economy-wide fee on CO emissions starting at $40 a ton and increasing every year at 5% above inflation.

Carbon Dividends for All Americans: All net proceeds from the carbon fee will be returned to the American people on an equal and quarterly basis.

Significant Regulatory Simplification: In the majority of cases where a carbon fee offers a more cost-effective solution, the fee will replace regulations. All current and future federal stationary source carbon regulations, for example, would be displaced or preempted.

Border Carbon Adjustments: Carbon-intensive exports to countries without comparable carbon pricing systems will receive rebates for carbon fees paid, while carbon-intensive imports from such countries will face fees on the carbon content of their products.

Also Check: Aldi Take And Bake Bread